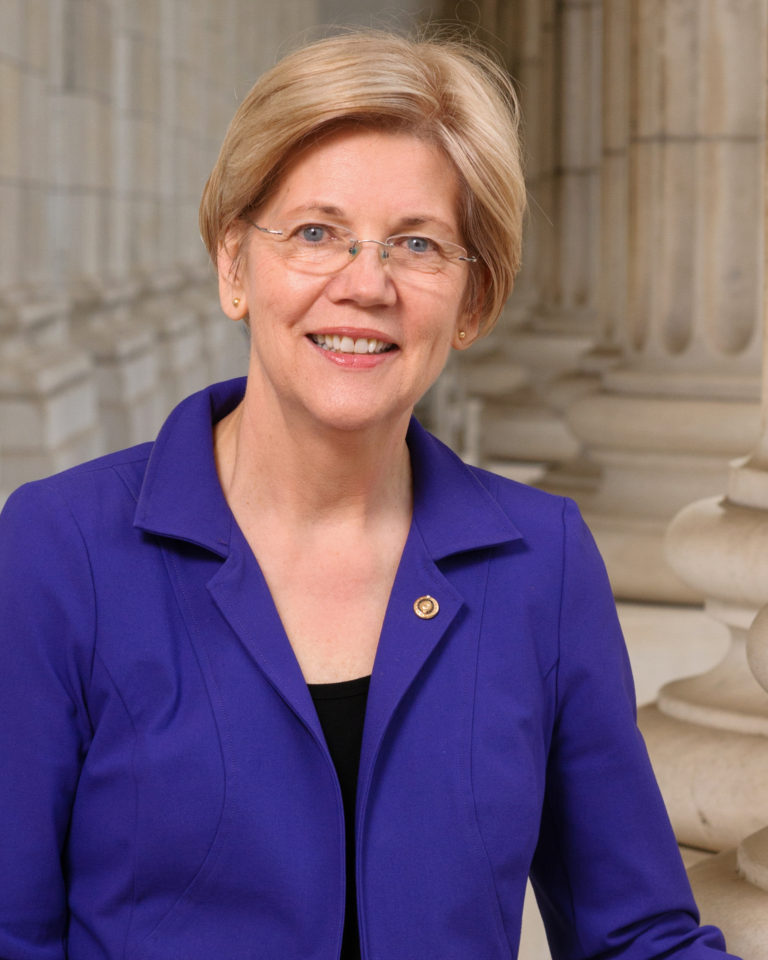

Sen. Elizabeth Warren (D-Mass.)

The new director of the Consumer Financial Protection Bureau, Mick Mulvaney, has suspended the bureau’s collection of personal identifying information when taking consumer complaints.

The move is in keeping with longstanding privacy concerns raised by CFPB critics, but has drawn the ire of bureau architect Sen. Elizabeth Warren (D-Mass.).

In December, Mulvaney announced plans to temporarily halt personal data collection after an inspector general’s report warned of cybersecurity problems with the agency. “I think we should find ways to have as rigorous a data security program as possible here before we start expecting that from people who we oversee out in the industry,” Mulvaney told reporters at the time.

A General Accounting Office report from September 2014 noted serious concerns about the privacy and security of the consumers whose data are being collected by the CFPB. The GAO found the CFPB was collecting more information than was necessary for its regulatory mission, from 87 percent of the credit card market totaling information on 173 million loans.

Later, in October of last year, the CFPB’s own Inspector General said: “The Office of Inspector General has…identified information security as a major management challenge for the CFPB. CFPB management needs to continue improving its information security program, overseeing the security of contractor-operated information systems, and ensuring that personally identifiable information is properly protected.”

Sen. Warren strongly objected to the agency’s temporary halt in data collection last week. “CFPB cannot fulfill its core functions without collecting personally identifiable information,” Warren wrote in a Jan. 4 letter to top CFPB officials.

“When a consumer submits a complaint, the CFPB asks for information, such as their name and account number, to enable the agency to help resolve the dispute,” Warren continued. “Examinations are data-driven and granular. If examiners aren’t able to request information from the relevant financial institution, they can’t do their job.”

The temporary halt is perfectly reasonable, said Ronald L. Rubin, a former CFPB enforcement lawyer and a former chief adviser on regulatory policy for the House Financial Services Committee. “Given Equifax and other problems, it’s hard to understand why you wouldn’t be cautious about data collection in any shape or form.” He added that the move was temporary. “People of all political backgrounds are concerned about their information being compromised.”