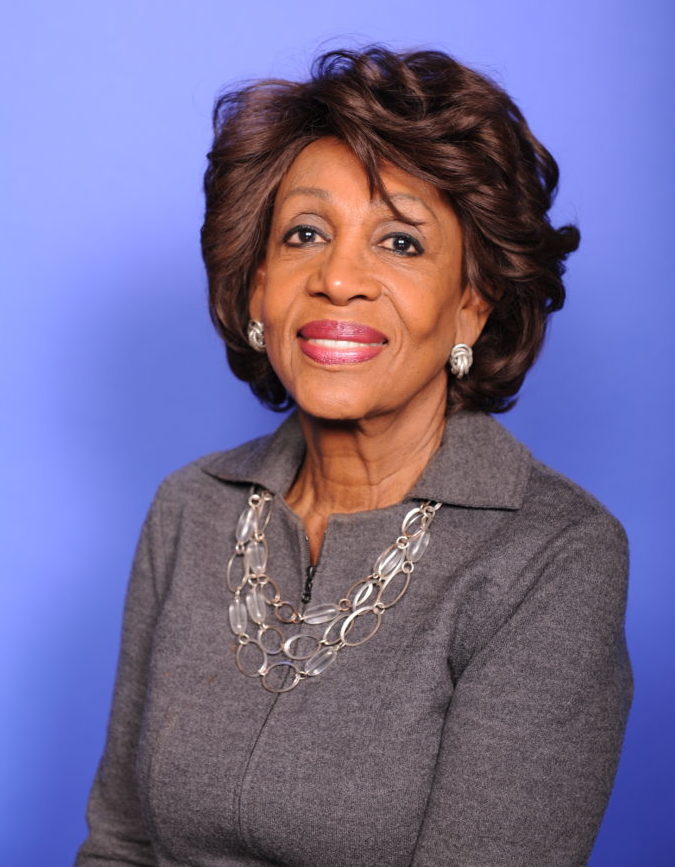

Rep. Maxine Waters (D-Calif.)

The U.S. House has passed a bill authored by Rep. Maxine Waters (D-Calif.) aimed at undoing many of the changes made at the Consumer Financial Protection Bureau by former acting director Mick Mulvaney.

The Consumers First Act passed the House 231 to 191 along party lines, with no Republican support. It would undo many of the efforts begun by Mulvaney to relax oversight of financial firms, roll back agency regulations, reorganize the agency’s structure and rebrand the agency.

The bill is unlikely to pass the Republican-controlled Senate.

“Putting Mick Mulvaney in charge of the consumer financial protection bureau was the epitome of a fox guarding the hen house, so we have to undo all of the damage he did while he was acting director of the CFPB,” Rep. Carolyn Maloney (D-N.Y.) said in a speech ahead of the vote.

Mulvaney and his efforts to rein in the agency were largely supported by Republicans, who have long been opponents of the bureau, a brainchild of Sen. Elizabeth Warren (D-Mass.). Mulvaney, a former Congressman from South Carolina, once called the CFPB a “sick, sad” joke.

“I introduced the Consumers First Act to fix the damage that Mulvaney caused at the Consumer Bureau,” Waters said. “The harm at the Consumer Bureau is continuing under Director Kathy Kraninger who appears to be following Mulvaney’s lead.”

The bill from Waters, who also chairs the House Financial Services Committee, would reverse those efforts and also bans future CFPB directors from replicating them.

It additionally imposes restrictions on the number of political appointees allowed at the CFPB, requirements for the agency’s advisory boards, and orders the bureau to use “Consumer Financial Protection Bureau” as its formal name. There was a scuffle over the bureau’s oifficial name of the agency last year, although current Director Kathy Kraninger has called a halt to renaming efforts.

The bill would also create an Office of Students and Young Consumers focused on student loans, debt repayment and financial product access for young adults and their families.